LON R. GREENBERG

Chairman andChief Executive Officer

December 16, 2014

Dear Shareholder,

On behalf of our entire Board of Directors, I cordially invite you to attend our Annual Meeting of Shareholders on Thursday, January 19, 2012.29, 2015. At the meeting, we will review UGI’s performance for Fiscal 2011the 2014 fiscal year and our expectations for the future.

I would like to take this opportunity to remind you that your vote is important. On December 9, 2011,16, 2014, we mailed our shareholders a notice containing instructions on how to access our 20112014 proxy statement and annual report and vote online. Please read the proxy materials and take a moment now to vote online or by telephone as described in the proxy voting instructions. Of course, if you received these proxy materials by mail, you may also vote by completing the proxy card and returning it by mail.

I look forward to seeing you on January 19th29th and addressing your questions and comments.

|

Sincerely,

Lon R. Greenberg

December 16, 2014

NOTICEOF

ANNUAL MEETINGOF SHAREHOLDERS

The Annual Meeting of Shareholders of UGI Corporation will be held on Thursday, January 19, 2012,29, 2015, at 10:00 a.m., at The Desmond Hotel and Conference Center, Ballrooms A and B, One Liberty Boulevard, Malvern, Pennsylvania. Shareholders will consider and take action on the following matters:

1. election of tennine directors to serve until the next annual meeting of Shareholders;

2. a non-binding advisory vote on a resolution to approve UGI Corporation’s executive compensation;

3. a non-binding advisory vote to determine the frequency with which shareholders will be asked to give an advisory vote on executive compensation;

4. transaction of any other business that is properly raised at the meeting.

Monica M. Gaudiosi

Corporate Secretary

|

This Proxy Statement and the Company’s 20112014 Annual Report are available atwww.ugicorp.com.

This summary highlights information contained elsewhere in this Proxy Statement. The summary does not contain all of the information that you should consider. Please read the entire Proxy Statement carefully before voting.

Annual Meeting of Shareholders

Time and Date: | 10:00 a.m. (Eastern Time), January 29, 2015 | |||

Place: | ||||

| Center, Ballrooms A & B One Liberty Boulevard, Malvern, Pennsylvania | ||||

Record Date: | November 12, 2014 | |||

Voting: | Shareholders as of the close of business on the record date are entitled to vote. Each share of common stock is entitled to one vote for each matter to be voted on. | |||

Voting Matters and Board Recommendations

| 1. | Election of nine directors; |

| 2. | Non-binding advisory vote on a resolution to approve the compensation of our named executive officers; and |

| 3. | Ratification of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 2015. |

| UGI Corporation’s Board of Directors recommends that you voteFORthe election of each of the director nominees andFORProposals 2 and 3. |

Executive Compensation Highlights

Corporate Governance Highlights

- 1 -

Advisory Vote to Approve Named Executive Officer Compensation

We are asking shareholders to approve, on an advisory basis, UGI CORPORATION460 North Gulph RoadKingCorporation’s executive compensation, including our executive compensation policies and practices and the compensation of Prussia, Pennsylvania 19406

At the 2014 Annual Meeting, Information

This result demonstrated clear support for our executive compensation policies and practices and our alignment of pay and performance.

| The Board of Directors recommends aFOR vote because it believes that the compensation policies and practices are effective in achieving UGI Corporation’s goals of paying for performance and aligning the executives’ long- term interests with those of our shareholders. |

Objectives and Components of our Compensation Program

The compensation program for our named executive officers is designed to provide a competitive level of total compensation necessary to attract and retain talented and experienced executives. Additionally, our compensation program is intended to motivate and encourage our executives to contribute to our success and reward our executives for leadership excellence and performance that promotes sustainable growth in shareholder value.

In Fiscal 2014, the components of our compensation program included salary, annual

bonus awards, a discretionary bonus award to one named executive officer, long-term incentive compensation (performance unit awards and UGI Corporation stock option grants), a discretionary restricted unit award to one named executive officer, limited perquisites, retirement benefits and other benefits, all as described in greater detail in the Compensation Discussion and Analysis of this Proxy Statement. We believe that the elements of our compensation program are essential components of a balanced and competitive compensation program to support our annual and long-term goals.

Pay for Performance

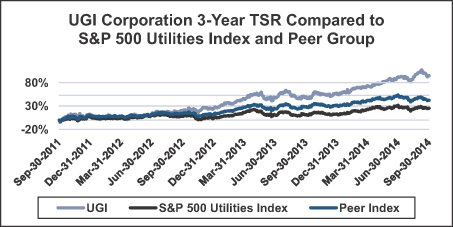

Our executive compensation program allows the Compensation and Management Development Committee and the Board to determine pay based on a comprehensive view of quantitative and qualitative factors designed to enhance shareholder value and align the long-term interests of executives and shareholders. For example, for the 2011-2013 performance period, UGI Corporation’s total shareholder return compared to its peer group was in the 50th percentile and Mr. Walsh received a performance unit payout of $1,250,970 during Fiscal 2014. For the 2010-2012 performance period, UGI Corporation’s total shareholder return compared to its peer group was in the 42nd percentile and Mr. Walsh received a performance unit payout of $597,764 during the 2013 fiscal year. For the 2009-2011 performance period, UGI Corporation’s total shareholder return compared to its peer group was in the 30th percentile and resulted in no payout during the 2012 fiscal year. For additional information on the alignment between our financial results and executive officer compensation, see Compensation Discussion and Analysis.

- 2 -

Questions and Answers About Proxy Materials, Annual Meeting and Voting

This proxy statement contains information related to the Annual Meeting of Shareholders of UGI Corporation (the “Company”) to be held on Thursday, January 19, 2012,29, 2015, beginning at 10:00 a.m., at The Desmond Hotel and Conference Center, Ballrooms A and B, One Liberty Boulevard, Malvern, Pennsylvania and at any postponements or adjournments thereof. Directions to The Desmond Hotel and Conference Center appear on page 79.61. This proxy statement was prepared under the direction of the Company’s Board of Directors to solicit your proxy for use at the Annual Meeting. It was made available to shareholders on or about December 9, 2011.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of printed proxy materials?

The Company has elected to provide access to the proxy materials over the Internet. We believe that this initiative enables the Company to provide proxy materials to shareholders more quickly, reducereduces the impact of our Annual Meeting on the environment, and reducereduces costs.

Who is entitled to vote?

Shareholders of record of our common stock at the close of business on November 14, 201112, 2014 are entitled to vote at the Annual Meeting, or any postponement or adjournment of the meeting scheduled in accordance with Pennsylvania law. Each shareholder has one vote per share on all matters to be voted on. On November 14, 2011,12, 2014, there were 115,458,302172,498,572 shares of common stock outstanding.

What am I voting on?

You will be asked to elect tennine nominees to serve on the Company’s Board of Directors, to provide an advisory vote on the Company’s executive compensation and on the frequency of future advisory votes on executive compensation and to ratify the appointment of our independent registered public accounting firm for Fiscal 2012.the fiscal year ending September 30, 2015 and any other business properly coming before the meeting. The Board of Directors is not aware of any other matters to be presented for action at the meeting.

-1-

You may vote in one of three ways:

-2-Over the Internet

If your shares are registered in your name: Vote your shares over the Internet by accessing the Computershare proxy online voting website at: www.envisionreports.com/UGI and following the on-screen instructions.

You will need the control number that appears on your Notice of Availability of Proxy Materials when you access the web page.

If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the Internet by following the voting instructions that you receive from such broker, bank or other nominee.

By Telephone

If your shares are registered in your name: Vote your shares over the telephone by accessing the telephone voting system toll-free at 800-652-8683 and following the telephone voting instructions. The telephone instructions will lead you through the voting process. You will need the control number that appears on your Notice of Availability of Proxy Materials when you call.

If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the telephone by following the voting instructions you receive from such broker, bank or other nominee.

By Mail

If you received these annual meeting materials by mail: Vote by signing and dating the proxy card(s) and returning the card(s) in the prepaid envelope. Also, you can vote online or by using a toll-free telephone number. Instructions about these ways to vote appear on the proxy card. If you vote by telephone, please have your proxy card and control number available.

How can I vote my shares held in the Company’s Employee Savings Plans?

You can instruct the trustee for the Company’s Employee Savings Plans to vote the shares of stock that are allocated to your account in the UGI Stock Fund. If you do not vote your shares, the trustee

- 3 -

will vote them in proportion to those shares for which the trustee has received voting instructions from participants. Likewise, the trustee will vote shares held by the trust that have not been allocated to any account in the same manner.

How can I change my vote?

You can revoke your proxy at any time before it is voted. Proxies are voted at the Annual Meeting. If you are a shareholder of record and you returned a paper proxy card, you can write to the Company’s Corporate Secretary at our principal offices, 460 North Gulph Road, King of Prussia, Pennsylvania 19406, stating that you wish to revoke your proxy and that you need another proxy card. Alternatively, you can vote again, either over the Internet or by telephone. If you hold your shares through a broker, bank or other nominee, you can revoke your proxy by contacting the broker, bank or other nominee and following their procedure for revocation. If you are a shareholder of record and you attend the meeting, you may vote by ballot, which will cancel your previous proxy vote. If your shares are held through a broker, bank or other nominee, and you wish to vote by ballot at the meeting, you will need to contact your bank, broker or other nominee to obtain a legal proxy form that you must bring with you to the meeting to exchange for a ballot. Your last vote is the vote that will be counted.

What is a quorum?

A quorum of the holders of the outstanding shares must be present for the Annual Meeting to be held. A “quorum” is the presence at the meeting, in person or represented by proxy, of the holders of a majority of the outstanding shares entitled to vote.

How are votes, abstentions and broker non-votes counted?

Abstentions are counted for purposes of determining the presence or absence of a quorum, but are not considered a vote cast under Pennsylvania law.

A broker non-vote occurs when a broker, bank or other nominee holding shares on your behalf does not receive voting instructions from you. If that happens, the broker, bank or other nominee may vote those shares only on matters deemed “routine” by the New York Stock Exchange, such asExchange. On non-routine matters, the ratification ofbroker, bank or other nominee cannot

vote those shares unless they receive voting instructions from the appointment of the Company’s independent registered public accounting firm.beneficial owner. A “broker non-vote” occurs when a broker has not received voting instructions and either declines to exercise its discretionary authority to vote on routine matters or is barred from doing so because the matter is non-routine. Broker non-votes are counted to determine if a quorum is present, but are not considered a vote cast under Pennsylvania law.

-3-

What vote is required to approve each item?

The Director nominees will be elected by a pluralitymajority of the votes cast at the Annual Meeting.

The approval, by advisory vote, of UGI Corporation’sthe Company’s executive compensation requires the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the 20122015 Annual Meeting. This vote is advisory in nature and therefore not binding on UGI Corporation, the Board of Directors or the Compensation and Management Development Committee. However, our Board of Directors and the Compensation and Management Development Committee value the opinions of the Company’s shareholders and expect towill consider the outcome of this vote in their future deliberations on the Company’s executive compensation programs.

- 4 -

The ratification of the appointment of PricewaterhouseCoopersErnst & Young LLP as our independent registered public accounting firm for Fiscal 20122015 requires the affirmative vote of a majority of the votes cast at the meeting to be approved.

Who will count the vote?

Computershare Inc., our Transfer Agent, will tabulate the votes cast by proxy or in person at the Annual Meeting.

What are the deadlines for Shareholders’Shareholder proposals for next year’s Annual Meeting?

Shareholders may submit proposals on matters appropriate for shareholder action as follows:

-4-

How much did this proxy solicitation cost?

The Company has engaged Georgeson Inc. to solicit proxies for the Company for a fee of $7,500 plus reasonable expenses for additional services. We also reimburse banks, brokerage firms and other institutions, nominees, custodians and fiduciaries for their reasonable expenses for sending proxy materials to beneficial owners and obtaining their voting instructions. Certain Directors, officers and regular employees of the Company and its subsidiaries may solicit proxies personally or by telephone or facsimile without additional compensation.

-5-

| Number of | ||||||||||||||||||||

| Number of UGI | Exercisable | Number of | AmeriGas | |||||||||||||||||

| Number | Stock Units | Options | AmeriGas | Partners, L.P. | ||||||||||||||||

| of Shares of UGI | Held Under | For UGI | Partners, L.P. | Phantom | ||||||||||||||||

| Name | Common Stock(1) | 2004 Plan(2) | Common Stock | Common Units | Units(3) | |||||||||||||||

| Stephen D. Ban | 16,496 | 63,438 | 80,000 | 0 | 1,014 | |||||||||||||||

| Eugene V. N. Bissell | 67,297 | (4) | 0 | 211,666 | 60,800 | (4) | 0 | |||||||||||||

| Richard W. Gochnauer | 0 | 2,550 | 8,500 | 0 | 0 | |||||||||||||||

| Richard C. Gozon | 32,608 | 99,998 | (5) | 59,500 | 5,659 | 0 | ||||||||||||||

| Lon R. Greenberg | 405,872 | (6) | 0 | 1,495,000 | 11,000 | 0 | ||||||||||||||

| Ernest E. Jones | 3,618 | 29,350 | 92,000 | 0 | 0 | |||||||||||||||

| Frank S. Hermance | 30,000 | (7) | 1,275 | 0 | 0 | 0 | ||||||||||||||

| Peter Kelly | 56,406 | (8) | 0 | 0 | 0 | 0 | ||||||||||||||

| Robert C. Flexon | 5,000 | 0 | 0 | 0 | 0 | |||||||||||||||

| Robert H. Knauss | 10,105 | 12,000 | 90,000 | 14,108 | 0 | |||||||||||||||

| Anne Pol | 3,021 | 64,860 | 74,000 | 0 | 0 | |||||||||||||||

| M. Shawn Puccio | 3,550 | 7,889 | 25,500 | 0 | 0 | |||||||||||||||

| Marvin O. Schlanger | 9,724 | (9) | 53,248 | 80,000 | 1,000 | (9) | 1,014 | |||||||||||||

| Francois Varagne | 42,239 | 0 | 109,000 | 0 | 0 | |||||||||||||||

| Roger B. Vincent | 16,504 | 16,505 | 51,000 | 6,000 | 0 | |||||||||||||||

| John L. Walsh | 126,253 | (10) | 0 | 535,000 | 7,000 | (10) | 0 | |||||||||||||

| Directors and executive officers as a group (19 persons) | 902,897 | 351,113 | 3,076,332 | 105,567 | 2,028 | |||||||||||||||

| NOMINEES |

-6-

| Title of | Name and Address of | Amount and Nature of | Percent of | |||||||

| Class | Beneficial Owner | Beneficial Ownership | Class(1) | |||||||

| Common Stock | Wellington Management Company, LLP 280 Congress Street Boston, MA 02210 | 9,161,365 | (2) | 7.93 | % | |||||

| Common Stock | State Street Corporation One Lincoln Street Boston, MA 02111 | 6,992,022 | (3) | 6.06 | % | |||||

-7-

Information about Director-Nominees

Biographical information, including business experience, and director positions with other public companies currently held, or held at any time during the last five years, is a nomineeincluded below for each of the first time.

The Board of Directors recommends that you vote “FOR” the election of each of the nine nominees for director.

| RICHARD W. GOCHNAUER Retired Chief Executive Officer, United Stationers, Inc. Director since 2011 Age 65 Member, Audit Committee Member, Corporate Governance Committee | |

Mr. Gochnauer retired in May 2011 as Chief Executive Officer and Director of the Technology Transfer DivisionUnited Stationers Inc. (a wholesale distributor of the Argonne National Laboratory (a science-based Department of Energy laboratory dedicatedbusiness products) (2002 to advancing the frontiers of science in energy, environment, biosciences and materials) in 2010, having served in such role since 2001.2011). He previously served as President and Chief ExecutiveOperating Officer and Vice Chairman and President, International, of the Gas Research Institute (gasGolden State Foods Corporation (a food service industry research and development institute funded by distributors, transporters, and producers of natural gas) (1987supplier) (1994 to 1999)2002). He also served as Executive Vice President. Prior to joining the Gas Research Institute in 1981, he was Vice President, Research and Development and Quality Control of Bituminous Materials, Inc. Dr. BanMr. Gochnauer also serves as a Director of AmerisourceBergen Corporation (a wholesale distributor of business products in the U.S. and internationally), Golden State Foods Corporation (a diversified supplier to the foodservice industry), and UGI Utilities, Inc., AmeriGas Propane, Inc.a subsidiary of the Company.

Mr. Gochnauer’s qualifications to serve as director include his extensive senior management experience as Chief Executive Officer of a large public company and Energen Corporation.

- 6 -

| LON R. GREENBERG Non-Executive Chairman of the Board and Former Chief Executive Officer Director since 1994 Age 64 Member, Executive Committee | |

Mr. Greenberg has been Non-Executive Chairman of the Board of Directors of UGI since 1996his April 2013 retirement as Chairman (a position he had held since 1996) and Chief Executive Officer (a position he had held since 1995.1995). He was formerly President (1994 to 2005), Vice Chairman of the Board (1995 to 1996), and Senior Vice President —– Legal and Corporate Development (1989 to 1994). Mr. Greenberg also serves as a Director and Non-Executive Chairman of AmeriGas Propane, Inc. and UGI Utilities, Inc., AmeriGas Propane,both of which are subsidiaries of UGI Corporation, and as a Director of Ameriprise Financial, Inc., AmerisourceBergen Corporation and Aqua America, Inc.

Mr. Greenberg’s qualifications to serve as a director include his executive leadership, and Ameriprise Financial, Inc.

| FRANK S. HERMANCE Chairman and CEO, AMETEK, Inc. Director since 2011 Age 65 Chair, Safety, Environmental and Regulatory Compliance Committee Member, Compensation and Management Development Committee | |

-8-

as a Director

Mr. Hermance’s qualifications to serve as a director include his extensive senior management experience in the roles of Chairman, Chief Executive Officer, President and Chief Operating Officer of Trex Enterprises Corporation (a high technology research and development company), a position she had held since 2001. She previously served as Senior Vice President of Thermo Electron Corporation (an environmental monitoring and analytical instruments company and a major producer of recycling equipment, biomedical products and alternative energy systems) (1998 to 2001), and Vice President (1996 to 1998). Mrs. Pollarge global public company. Mr. Hermance also served as President of Pitney Bowes Shipping and Weighing Systems Division, a business unit of Pitney Bowes Inc. (mailing and related business equipment) (1993 to 1996); Vice President of New Product Programsprovides relevant experience in the Mailing Systems Divisionareas of Pitney Bowes Inc. (1991 to 1993)corporate governance, mergers and Vice Presidentacquisitions, human resources management, logistics, distribution, risk management and executive compensation. As an executive of Manufacturing Operations ina company with global operations, Mr. Hermance also provides the Mailing Systems Division of Pitney Bowes Inc. (1990 to 1991). Mrs. Pol also serves as a Director of UGI Utilities, Inc.

-9-

| ERNEST E. JONES President, EJones Consulting, LLC and Former President and CEO, Philadelphia Workforce Development Corp. Director since 2002 Age 70 Chair, Corporate Governance Committee Member, Compensation and Management Development Committee | |

Mr. Jones’ qualifications to serve as a director include his extensive experience managing government and non-profit organizations as Chief Executive Officer, his public and private company directorship experience and his insight into workforce, regulatory, banking and legal issues. Mr. Jones possesses a critical understanding of the Company’s business operations, strategic growth opportunities, and corporate governance matters.

| ANNE POL Retired President and Chief Operating Officer, Trex Enterprises Corp. Director 1993 through 1997 and since 1999 Age 67 Member, Compensation and Management Development Committee Member, Safety, Environmental and Regulatory Compliance Committee | |

Mrs. Pol retired in 2009.

Mrs. Pol’s qualifications to 2010). Mr. Vincent serves as Chairman of the Board of Trustees of the ING Unified Funds andserve as a Director of UGI Utilities, Inc. He previously serveddirector include her strategic planning, business development and technology experience as a Directorsenior-level executive with a diversified high-technology company. Mrs. Pol also possesses an important understanding of, AmeriGas Propane, Inc.,and extensive experience in, the general partnerareas of AmeriGas Partners, L.P., ending in 2006.

-10-

| M. SHAWN PUCCIO Senior Vice President, Finance, Saint-Gobain Corporation Director since 2009 Age 52 Member, Audit Committee Member, Safety, Environmental and Regulatory Compliance Committee | |

Ms. Puccio’s qualifications to serve as a director include her senior financial executive management experience with a global company and her extensive public accounting knowledge and experience. Her education (Ms. Puccio has a bachelor’s degree in accounting from Marquette University and a Master of Eastern Pennsylvania.

| MARVIN O. SCHLANGER Principal, Cherry Hill Chemical Investments, L.L.C. Director since 1998 Age 66 Presiding Director Chair, Compensation and Management Development Committee Chair, Executive Committee Member, Corporate Governance Committee | |

Mr. Gochnauer retiredSchlanger is a Principal in May 2011the firm of Cherry Hill Chemical Investments, L.L.C. (a management services and capital firm for chemical and allied industries) (since 1998). Mr. Schlanger previously served as Chief Executive Officer of CEVA Holdings BV and CEVA Holdings, LLC, an international logistics supplier (2012 to 2013). Mr. Schlanger is currently a Directordirector of United StationersAmeriGas Propane, Inc. (a wholesale distributor, and UGI Utilities, Inc., both of which are subsidiaries of UGI Corporation. He is also a director of Taminco Global Chemical Holdings, LLP, an integrated producer of alkylamines and alkylamine derivatives, CEVA Logistics B.V. and CEVA Holdings, LLC, where he serves as chairman, and Momentive Specialty Chemical Holdings, LLC. Mr. Schlanger was previously a director of LyondellBassell Industries (until 2013) and Hexion Specialty Chemicals Inc., now known as Momentive Specialty Chemicals Inc. (until 2010).

Mr. Schlanger’s qualifications to serve as a director include his senior management, strategic planning, business products) (2002 to 2011). He previously serveddevelopment, risk management, and general operations experience throughout his career as President andChief Executive Officer, Chief Operating Officer, and Vice ChairmanChief Financial Officer of Arco Chemical Company, a large public company. As an executive having worked for a company with global operations, Mr. Schlanger also provides the Board with international experience. The Board also considered Mr. Schlanger’s experience serving as chairman, director and committee member on the boards of directors of large public and private international companies, including his experience serving on boards of directors of public companies as a result of being nominated by a major shareholder.

- 9 -

| ROGER B. VINCENT Retired President, Springwell Corporation Director since 2006 Age 69 Chair, Audit Committee Member, Executive Committee | |

Mr. Vincent retired in 2011 from his position as President International, of Golden State FoodsSpringwell Corporation, (a food service industry supplier) (1994 to 2002).a corporate finance advisory firm he founded in 1989. Prior to that,1989, Mr. Gochnauer servedVincent held various positions at Bankers Trust Company, including managing director. Mr. Vincent serves as Executive Vice PresidentTrustee and Former Chairman of the Dial Corporation, with responsibility for its householdBoard of the VOYA Funds and laundry consumer products businesses. Mr. Gochnauer also serves as a Director of UGI Utilities, Inc., AmerisourceBergen Corporationa subsidiary of the Company. He previously served as a Director of AmeriGas Propane, Inc., a subsidiary of the Company, from 1998 to 2006.

Mr. Vincent’s qualifications to serve as a director include his extensive experience as founder and Golden State Foodssenior executive of a corporate finance advisory firm, as well as his prior experience as a managing partner at a major banking institution. In addition, the Board considered Mr. Vincent’s many years serving as a director and trustee at various funds of a registered investment company, his service as a member or chair of the audit committees for public companies and funds, and his investment banking, capital market and financial expertise. Mr. Vincent’s education (Mr. Vincent has a bachelor’s degree in mathematics and engineering from Yale University and a Master of Business Administration degree with a concentration in finance from Harvard University) and experience provide him with financial expertise.

| JOHN L. WALSH President and Chief Executive Officer Director since 2005 Age 59 Member, Executive Committee | |

Mr. Walsh is a Director and President (since 2005) and Chief Executive Officer (since 2013) of UGI Corporation.

In addition, Mr. Walsh serves as a Director

Mr. Walsh’s qualifications to serve as a director include his extensive strategic planning, operational and executive leadership experience as the Company’s CEO and President, his previous service as the Company’s Chief Operating Officer, (1996 to 1999).and his prior senior management experience with a global public company. Mr. Hermance is a memberWalsh has in-depth knowledge of the BoardCompany’s businesses, competition, risks, and health, environmental and safety issues. Mr. Walsh, by virtue of Trustees of the Rochester Institute of Technologyhis current position and Chairman of the Greater Philadelphia Alliance for Capitalhis previous position at a multinational industrial gas company, possesses international experience, as well as management development and Technologies. He also serves as a Director of IDEX Corporation and as a member of the Compensation Committee of the IDEX Board.

-11-

| CORPORATE GOVERNANCE |

The business of UGI Corporation is managed under the direction of the Board of Directors. As part of its duties, the Board oversees the corporate governance of the Company for the purpose of creating long-term value for its shareholders and safeguarding its commitment to its other stakeholders: our employees, our customers, our suppliers and creditors, and the communities in which we do business. To accomplish this purpose, the Board considers the interests of the Company’s stakeholdersshareholders when, together with management, it sets the strategies and objectives of the Company.

The Board, also evaluates management’s performancerecognizing the importance of good corporate governance in pursuing those strategies and achieving those objectives.

The full text of the Company’s Principles of Corporate Governance can be found on the Company’s website,www.ugicorp.com, under Investor Relations, Corporate Governance or in print, free of charge, upon written request.

The Board has determined that, other than Messrs. Greenberg and Corporate Governance. Walsh, no Director has a material relationship with the Company, and each Director satisfies the criteria for an “independent director” under the rules of the New York Stock Exchange.

The Board has established the following guidelines to assist it in determining director independence:

(i) if a Director serves as an officer, director or trustee of a non-profit organization, charitable contributions to that organization by the Company has also adopted (i)and its affiliates in an amount up to $250,000 per year will not be considered to result in a Code of Ethics for the Chief Executive Officer and Senior Financial Officers that applies to the Company’s Chief Executive Officer, Principal Financial Officer and Chief Accounting Officer, and (ii) a Code of Business Conduct and Ethics for Directors, Officers and Employees. Both Codesmaterial relationship between such Director and the ChartersCompany, and

(ii) service by a Director or his immediate family member as an executive officer or employee of a company that makes payments to, or receives payments from, the Company or its affiliates for property or services in an amount that, in any of the Corporate Governance, Audit,last three fiscal years, did not exceed the greater of $1 million or 2% of such other company’s consolidated gross revenues will not be considered to result in a material relationship between such Director and Compensationthe Company.

In making its determination of independence, the Board considered ordinary business transactions between Ms. Puccio’s and Management Development CommitteesMr. Hermance’s employers and subsidiaries of the Company that were in compliance with the categorical standards set by the Board of Directors are posted on the Company’s website,www.ugicorp.com, under Investor Relations and Corporate Governance. All of these documents are also available free of charge by writing to Hugh J. Gallagher, Treasurer, UGI Corporation, P.O. Box 858, Valley Forge, PA 19482, or by calling 1-800-844-9453.

for determining director independence.

-12-

The Board of Directors determines whichthe most appropriate Board leadership structure best serves its needsto ensure effective and thoseindependent leadership while also ensuring appropriate insight into the operations and strategic issues of our shareholders.the Company. Currently, the Company’s Board leadership consists of a non-executive Chairman, a Presiding Director and strong committee chairmen. Mr. Greenberg serveshas served as bothNon-Executive Chairman ofsince his retirement from the Board of Directors and Chief Executive Officer of the Company.Company in 2013. The Board believes that the Company is best served by having Mr. Greenberg serve in both capacities has the following advantages for the Company: there is a single source of leadership and authority for the Board; the preparation for Board meetings, in particular the format and content of Board presentations, is very efficient; there is no needas Non-Executive Chair due to incur additional costs by providing a separate chairman with administrative support and increased compensation; and Mr. Greenberg’shis unique, in-depth knowledge of the Company’s corporate strategy and operating history enhances effective communication between the Board and management. The Board may separate the roles of Chairman and Chief Executive Officer in the future if circumstances change, such as in connection with a transition in leadership.

- 11 -

Senior management of the Company is responsible for assessing and managing risk. Senior management has developed an enterprise risk is the responsibility of senior management ofprocess intended to identify, prioritize and monitor key risks that may affect the Company. Our Board plays an important role in overseeing management’s performance of these functions. TheIn addition to general oversight by the Board, the Board has approved the charter of its Audit Committee, and the charter sets out the primary responsibilities of the Audit Committee. Those responsibilities require the Audit Committee to discuss with management, the general auditor and the independent auditors the Company’s enterprise risk management policies and risk management processes, including major risk exposures, risk mitigation, and the design and effectiveness of the Company’s processes and controls to prevent and detect fraudulent activity.

Our businesses are subject to a number of risks and uncertainties, which are described in detail in our Annual Report on Form 10-K for the year ended September 30, 2011.2014. Throughout the year, in conjunction with its regular business presentations to the Board and its committees, management highlights significant related risks and risk mitigation plans. Management also reports to each of the Audit CommitteeCommittees and the Board on steps being taken to enhance management processes and controls in light of evolving market, business, regulatory and other conditions. The ChairmanChair of the Auditeach Committee reports to the entire Board on the Audit Committee’stheir respective committee’s activities and decisions. In addition, on an annual basis, an extended meeting of the Board is dedicated to reviewing the Company’s shortshort- and long-term strategies and objectives, including consideration of significant risks to the execution of those strategies and the achievement of the Company’s objectives.

Board Meetings and Chief Executive Officer is ultimately responsible for the effectiveness of the Company’s risk management processes and he is an integral part of our day-to-day execution of those processes. As a result of his dual role, Mr. Greenberg’s ability to lead management’s risk management program and to assist in the Board’s oversight of that program improves the effectiveness of both the Board’s leadership structure and its oversight of risk.

Attendance

-13-

Annually, the Corporate Governance Committee monitors and assesses the structure, composition, operations and performance of the Board and, if appropriate, makes recommendations for changes.

The Boardcharters of Directors has established the Audit Committee, the Compensation and Management Development Committee, the ExecutiveCorporate Governance Committee, and theSafety, Environmental and Regulatory Compliance Committee can be found on our Company’s website,www.ugicorp.com, under Investor Relations, Corporate Governance Committee. Allor in print, free of these Committees are responsible to the full Board of Directors. The functions of and other information about these Committees are summarized below.

| Name | Audit Committee | Corporate Governance Committee | Compensation and Management Development Committee | Executive Committee | Safety, Environmental and Regulatory Compliance Committee | ||||||||||

R. W. Gochnauer | 1, 2 | X | X | ||||||||||||

L. R. Greenberg | |||||||||||||||

| X | |||||||||||||||

F. S. Hermance | 1 | X | Chair | ||||||||||||

E. E. Jones | 1 | Chair | X | ||||||||||||

A. Pol | 1 | X | X | ||||||||||||

M. S. Puccio | 1, 2 | X | X | ||||||||||||

M. O. Schlanger | 1, 3 | X | Chair | Chair | |||||||||||

R. B. Vincent | |||||||||||||||

| 1, 2 | Chair | X | |||||||||||||

J. L. Walsh | |||||||||||||||

| X | |||||||||||||||

| (1) | Independent Director |

| (2) | Audit Committee Financial Expert |

| (3) | Presiding Director |

-14-

Audit Committee

Each of the members of the Audit Committee is “independent” as defined by the New York Stock Exchange listing standards.

MEETINGS HELD LAST YEAR: 7

Compensation and Management Development Committee

-15-

Each of the members of the Compensation and Management Development Committee is “independent” as defined by the New York Stock Exchange listing standards.

MEETINGS HELD LAST YEAR: M.O. Schlanger (Chairman), E.E. Jones,5

Corporate Governance Committee

The Corporate Governance Committee (i) identifies nominees and A. Pol.

Each of the members of the Committee is “independent” as defined by the New York Stock Exchange listing standards.

MEETINGS HELD LAST YEAR: 5

Safety, Environmental and Regulatory Compliance Committee

The Safety, Environmental and Regulatory Compliance Committee (i) reviews the adequacy of, and provides oversight with respect to, the Company’s safety, environmental and regulatory compliance policies,

- 13 -

programs, procedures, initiatives and training; (ii) reviews risks associated with the Company’s international businesses; (iii) reviews reports regarding the Company’s code of ethical conduct for employees to the extent relating to safety, environmental or regulatory compliance matters; and (iv) keeps abreast of the regulatory environment within which the Company operates.

Each of the members of the Committee is “independent” as defined by the New York Stock Exchange listing standards.

MEETINGS HELD LAST YEAR: 3

Executive Committee

The Committee has limited powers to act on behalf of the Board of Directors between regularly scheduled meetings on matters that cannot be delayed.

MEETINGS HELD LAST YEAR: 4

The members of the Compensation and Management Development Committee are Mr.Messrs. Schlanger, Mr.Hermance and Jones and Mrs. Pol. None of the members is a former or current officer or employee of the Company or any of its subsidiaries, or is an executive officer of another company where an executive officer of UGI Corporation is a director.

Executive Committee

-16-

The Corporate Governance Committee seeks director candidates based upon a number of qualifications, including their independence, knowledge, judgment, character, leadership skills, education, experience, financial literacy, standing in the community, and ability to foster a diversity of backgrounds and views and to complement the Board’s existing strengths. The Committee seeks individuals who have a broad range of demonstrated abilities and accomplishments in areas of importance to the Company, such as general management, finance, energy distribution, international business, law and public sector activities. Directors should also possess a willingness to challenge and stimulate management and the ability to work as part of a team in a collegial atmosphere. The Committee also seeks individuals who are capable of devoting the required amount of time to serve effectively on the Board and its Committees. With respect to incumbent Directors, the Committee also considers past performance of the Director on the Board. As part of the process of selecting independent Board candidates, the Committee obtains an opinion of the Company’s General Counsel that there is no reason to believe that the Board candidate is not “independent” as defined by the New York Stock Exchange listing standards. The Committee generally relies upon recommendations from a wide variety of its business contacts, including current non-management Directors, executive officers, community leaders, and shareholders as a source for potential Board candidates. The Committee may also use the services of a third-party executive search firm to assist it in identifying and evaluating possible nominees for director. Mr. Hermance was recommended to the Committee as a possible nominee by a third-party executive search firm.

The Committee conducts an annual assessment of the composition of the Board and Committees and reviews with the Board the appropriate skills and characteristics required of Board members. When considering whether the Board’s Directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to satisfy the oversight responsibilities of the Board, the Committee and the Board consideredconsider primarily the information about the backgroundsbackground, experience and experiencesskills of each of the nominees contained under the caption “Nominees” on pages 8 to 11. In particular, with regard to Dr. Ban, the Board considered his extensive energy industry and emerging energy technologies knowledge and experience, including his experience as Chief Executive Officerdescribed in Item 1, Election of the Gas Research Institute, and his public company directorship and committee experience. With regard to Mr. Greenberg, the Board considered his executive leadership and vision demonstrated in leading the Company’s successful growth for more than 16 years, and his extensive industry knowledge and experience. With regard to Mr. Schlanger, the Board considered his senior management experience as Chief Executive Officer, Chief Operating Officer, and Chief Financial Officer of Arco Chemical Company, a large public company, and his experience serving as chairman, director and committee member on the boards of directors of large public and private international companies, including his experience serving on boards of directors of public companies as a result of being nominated by a major shareholder. With regard to Mrs. Pol, the Board considered her significant experience as a senior executive managing high technology, traditional manufacturing and services businesses, including experience in human resource management, and her insight into government regulatory issues. With regard to Mr. Jones, the Board considered his extensive experience managing government and non-profit organizations as Chief Executive Officer, his public and private company directorship experience and his insight into workforce, regulatory, banking and legal issues. With regard to Mr. Walsh, the Board considered his experience managing the Company as Chief Operating Officer, his prior senior management experience with a global public company, and his broad industry knowledge and insight. With regard to Mr. Vincent, the Board considered his senior executive experience in banking and

Directors.

-17-

- 14 -

for the previous year’s annual meeting. Notification must include certain information detailed in the Company’s bylaws.Bylaws. If you intend to nominate a candidate from the floor at anthe annual meeting, please contact the Corporate Secretary.

Director Stock Ownership Guidelines

The Board of Directors has a policy requiring Directors to own Company common stock, together with stock units, in an aggregate amount equal to five times the Director’s annual cash retainer, and to achieve the target level of common stock ownership within five years after joining the Board.

The Company has also adopted (i) a Code of Ethics for the Chief Executive Officer and Senior Financial Officers that applies to the Company’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, and (ii) a Code of Business Conduct and Ethics for Directors, Officers and Employees. Both Codes are posted on the Company’s website,www.ugicorp.com, under Investor Relations – Corporate Governance Committee Members:

You may contact the Board of Directors, an individual non-management director, or the non-management Directors as a group by writing to them c/o UGI Corporation, P.O. Box 858, Valley Forge, PA 19482. These contact instructions have been posted on the Company’s website atwww.ugicorp.com under Investor Relations and– Corporate Governance.

Any communications directed to the Board of Directors, an individual non-management director, or the non-management Directors as a group from employees or others that concern complaints regarding accounting, financial statements, internal controls, ethical, or auditing matters will be handled in accordance with procedures adopted by the Audit Committee of the Board.

Committee.

-18-

Typically, we do not forward to our Board of Directors communications from our shareholders or other parties whichthat are of a personal nature or are not related to the duties and responsibilities of the Board, including, customer complaints,but not limited to junk mail and mass mailings, resumes and other forms of job inquiries, opinion surveys and polls, and business solicitations.

-19-

| COMPENSATIONOF DIRECTORS |

| Change in | ||||||||||||||||||||||||||||

| Pension Value | ||||||||||||||||||||||||||||

| Fees | Non-Equity | and | ||||||||||||||||||||||||||

| Earned | Incentive | Nonqualified | All | |||||||||||||||||||||||||

| or Paid | Stock | Option | Plan | Deferred | Other | |||||||||||||||||||||||

| in Cash | Awards | Awards | Compen- | Compensation | Compensation | Total | ||||||||||||||||||||||

| Name | ($)(1) | ($)(2) | ($)(3) | sation ($) | Earnings ($)(4) | ($) | ($) | |||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||||||||||||||

| S. D. Ban | 67,000 | 137,220 | 46,155 | 0 | 0 | 0 | 250,375 | |||||||||||||||||||||

| R. W. Gochnauer | 43,228 | 82,518 | 46,155 | 0 | 0 | 0 | 171,901 | |||||||||||||||||||||

R. C. Gozon(5) | 20,472 | 170,937 | 46,155 | 0 | 0 | 0 | 237,564 | |||||||||||||||||||||

| F.S. Hermance | 2,068 | 34,884 | 0 | 0 | 0 | 0 | 36,952 | |||||||||||||||||||||

| E. E. Jones | 65,472 | 105,782 | 46,155 | 0 | 1,142 | 0 | 218,551 | |||||||||||||||||||||

| A. Pol | 67,000 | 138,531 | 46,155 | 0 | 742 | 0 | 252,428 | |||||||||||||||||||||

| M.S. Puccio | 67,000 | 85,989 | 46,155 | 0 | 0 | 0 | 199,144 | |||||||||||||||||||||

| M. O. Schlanger | 72,000 | 127,822 | 46,155 | 0 | 0 | 0 | 245,977 | |||||||||||||||||||||

| R. B. Vincent | 72,000 | 93,636 | 46,155 | 0 | 0 | 0 | 211,791 | |||||||||||||||||||||

| Director Compensation Table – Fiscal 2014 | ||||||||||||||||||||||||||||

| Name |

| Fees Earned or Paid in Cash ($)(1) |

|

| Stock Awards ($)(2) |

|

| Option Awards ($)(3) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Change in Pension Value And Nonqualified Deferred Compensation Earnings ($)(4) |

|

| All Other Compensation ($) |

|

| Total ($) |

| |||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||||||||||||||

R. W. Gochnauer | 82,000 | 123,330 | 61,778 | 0 | 0 | 0 | 267,108 | |||||||||||||||||||||

L. R. Greenberg | 400,000 | 0 | 0 | 0 | 0 | 0 | 400,000 | |||||||||||||||||||||

F. S. Hermance | 84,500 | 121,768 | 61,778 | 0 | 0 | 0 | 268,046 | |||||||||||||||||||||

E. E. Jones | 87,000 | 155,343 | 61,778 | 0 | 1,283 | 0 | 305,404 | |||||||||||||||||||||

A. Pol | 77,000 | 197,758 | 61,778 | 0 | 834 | 0 | 337,370 | |||||||||||||||||||||

M. S. Puccio | 82,000 | 129,708 | 61,778 | 0 | 0 | 0 | 273,486 | |||||||||||||||||||||

M. O. Schlanger | 112,000 | 183,888 | 61,778 | 0 | 0 | 0 | 357,666 | |||||||||||||||||||||

R. B. Vincent | 92,000 | 139,999 | 61,778 | 0 | 0 | 0 | 293,777 | |||||||||||||||||||||

| (1) | Annual Retainers. |

-20-

| (2) | Stock Awards. All Directors named above, | |

- 16 -

| (3) | Stock Options. All non-management Directors, | |

| (4) | The amounts shown in column (f) represent above-market earnings on deferred compensation. Earnings on deferred compensation are considered above-market to the extent that the rate of interest exceeds 120 percent of the applicable federal long-term rate. For purposes of the Director Compensation Table | |

-21-

REPORTOFTHE COMPENSATIONAND MANAGEMENT DEVELOPMENT COMMITTEEOF THE BOARDOF DIRECTORS |

The Committee has reviewed and discussed with management theCompensation Discussion and Analysis included in this proxy statement. Based on this review and discussion, the Committee recommended to the Company’s Board of Directors, and the Board of Directors approved, the inclusion of theCompensation Discussion and Analysis in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 20112014 and the Company’s proxy statement for the 20122015 Annual Meeting of Shareholders.

Compensation and Management

Development Committee

Marvin O. Schlanger, Chairman

Frank S. Hermance

Ernest E. Jones

Anne Pol

- 17 -

| REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS |

The Audit Committee is composed of independent Directors as defined by the rules of the New York Stock Exchange and acts under a written charter adopted by the Board of Directors. As described more fully in its charter, the role of the Committee is to assist the Board of Directors in its oversight of the quality and integrity of the Company’s financial reporting process. The Committee also has the sole authority to appoint, retain, fix the compensation of and oversee the work of the Company’s independent auditors.

In this context, the Committee has met and held discussions with management and the independent auditors to review and discuss the Company’s internal control over financial reporting, the interim unaudited financial statements, and the audited financial statements for Fiscal 2011.2014. The Committee also reviewed management’s report on internal control over financial reporting, required under Section 404 of the Sarbanes-Oxley Act of 2002. As part of this review, the Committee reviewed the bases for management’s conclusions in that report and the report of the independent registered public accountants on the effectiveness of the Company’s internal control over financial reporting. The Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees,as amended, and as adopted by the Public Company Accounting Oversight Board, and the independent auditors’ independence. In addition, the Committee has received the written disclosures and the letter from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence.

-22-

The members of the Committee are not professionally engaged in the practice of auditing or accounting. The members of the Committee rely, without independent verification, on the information provided to them and on the representations made by management and the independent auditors. Accordingly, the Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with auditing standards generally accepted in the United States of America, that the financial statements are presented in accordance with accounting principles generally accepted in the United States of America or that our auditors are, in fact, “independent.”

PricewaterhouseCoopers LLP served as the Company’s independent registered public accounting firm for Fiscal 2014 and its audit report appears in our Annual Report on Form 10-K for the fiscal year ended September 30, 2014. As a result of the Audit Committee’s request for proposal process for audit services that was conducted during Fiscal 2014, the Audit Committee selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2015 fiscal year.

Based upon the reviews and discussions described in this report, the Committee recommended to the Board of Directors, and the Board of Directors approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 20112014 for filing with the SEC.

Audit Committee

Roger B. Vincent, ChairmanAnne Pol

Richard W. Gochnauer

M. Shawn Puccio

- 18 -

| OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

In the course of its meetings, the Audit Committee considered whether the provision by PricewaterhouseCoopers LLP of the professional services described below was compatible with PricewaterhouseCoopers LLP’s independence. The Committee concluded that our independent registered public accounting firm is independent from the Company and its management.

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the Company’s independent accountants. In recognition of this responsibility, the Audit Committee has a policy of pre-approving all audit and permissible non-audit services provided by the independent accountants.

The Audit Committee has delegated such approval authority to its chairman, to be exercised in the intervals between meetings, in accordance with the Audit Committee’s pre-approval policy.

-23-

| 2011 | 2010 | |||||||

Audit Fees(1) | $ | 3,421,000 | $ | 3,146,650 | ||||

| Audit-Related Fees | 0 | 0 | ||||||

Tax Fees(2) | 600,000 | 600,000 | ||||||

All Other Fees(3) | 3,000 | 212,000 | ||||||

| Total Fees for Services Provided | $ | 4,024,000 | $ | 3,958,650 | ||||

| 2014 | 2013 | |||||||

Audit Fees(1) | $ | 7,896,372 | $ | 4,432,304 | ||||

Audit-Related Fees(2) | 350,000 | 11,000 | ||||||

Tax Fees(3) | 546,000 | 634,825 | ||||||

All Other Fees(4) | 11,900 | 160,353 | ||||||

|

|

|

| |||||

Total Fees for Services Provided | $ | 8,804,272 | $ | 5,238,482 | ||||

| (1) | Audit Fees were for audit services, including (i) the annual audit of the consolidated financial statements of the Company, (ii) subsidiary audits, (iii) review of the interim financial statements included in the Quarterly Reports on Form 10-Q of the Company, AmeriGas Partners and UGI Utilities, Inc., and (iv) services that only the independent registered public accounting firm can reasonably be expected to provide, including the issuance of comfort letters. In addition, Audit Fees include $1,999,478 for audit services related to a three-year audit of UGI International. | |

| (2) | Audit-Related Fees were for due diligence associated with a potential acquisition in France. |

| (3) | Tax Fees were for the preparation of Substitute Schedule K-1 forms for unitholders of AmeriGas |

All Other Fees |

As a result of the Audit Committee’s request for Approval of Related Person Transactions

- 19 -

| POLICYFOR APPROVALOF RELATED PERSON TRANSACTIONS |

The Company’s Board of Directors has a written policy for the review and approval of Related Person Transactions. The policy applies to any transaction in which (i) the Company or any of its subsidiaries is a participant, (ii) any related person has a direct or indirect material interest, and (iii) the amount involved exceeds $120,000, except for any such transaction that does not require disclosure under SEC regulations. The Audit Committee of the Board of Directors, with assistance from the Company’s General Counsel, is responsible for reviewing, approving and ratifying related person transactions. The Audit Committee intends to approve or ratify only those related person transactions that are in, or not inconsistent with, the best interests of the Company and its shareholders.

| COMPENSATION DISCUSSIONAND ANALYSIS |

-24-

Compensation decisions for Messrs. Greenberg, Walsh, Knauss, KellyOliver, and FlexonHall and Ms. Gaudiosi were made by the independent members of our Board of Directors after receiving the recommendations of its Compensation and Management Development Committee. Compensation decisions for Mr. BissellSheridan were made by the independent members of the Board of Directors of AmeriGas Propane, Inc. (“AmeriGas Propane”), the General Partner of AmeriGas Partners, L.P. (“AmeriGas Partners”) after receiving the recommendation of its Compensation/Pension Committee. Compensation decisions for Mr. Varagne were approved by the independent members of our Board of Directors after receiving the recommendation of our Compensation and Management Development Committee, as well as by the Board of Directors of Antargaz’ parent company, AGZ Holding. For ease of understanding, we will use the term “we” to refer to UGI Corporation and AmeriGas Propane, Inc. and/or AGZ Holding and the term “Committee” or “Committees” to refer to the UGI Corporation Compensation and Management Development Committee and/or the AmeriGas Propane, Inc. Compensation/Pension Committee, as appropriate, in the relevant compensation decisions, unless the context indicates otherwise. We refer to our 20112014, 2013, and 20102012 fiscal years as “Fiscal 2011”2014,” “Fiscal 2013,” and “Fiscal 2010,2012,” respectively.

On July 29, 2014, our Board of Directors approved a numberthree-for-two split of months earlier, he did not participate in the Company’s annual bonus plancommon stock. The record date for the stock split was August 22, 2014 and was not awarded any new equity compensation in Fiscal 2011.

- 20 -

Our compensation program for named executive officers is designed to:

-25-

| • |

|

The following are some of the Company’s Fiscal 2014 performance highlights:

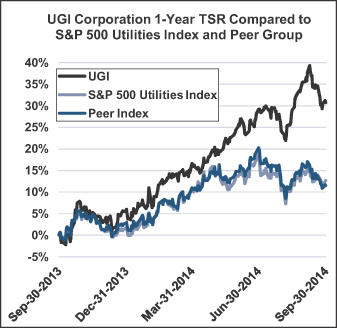

• Adjusted earnings per share1 (“Adjusted EPS”) increased 26% to $1.99; • Net income attributable to UGI Corporation increased 21%; • The Board of Directors approved a 3-for-2 stock split; • The Board of Directors increased the annual dividend by over 10%; and • As illustrated in the accompanying chart, the Company’s one-year total shareholder return was over 35%, significantly outperforming the S&P 500 Utilities Index and the peer group referenced by the Compensation Committee for purposes of its long-term compensation plan. |

|

1 UGI Corporation’s Fiscal 2014 earnings per share is adjusted to exclude (i) Midstream and Marketing’s and AmeriGas Propane’s net loss on commodity derivative instruments not associated with Fiscal 2014 transactions ($.04 per diluted share), and (ii) the retroactive impact of changes in French tax law ($.03 per diluted share).

- 21 -

| • | Fiscal 2014 Components |

The following chart provides a brief summary ofsummarizes the principal elements of our Fiscal 2014 executive compensation program for Fiscal 2011.program. We describe these elements, as well as a discretionary bonus and discretionary equity grant awarded to Ms. Gaudiosi and Mr. Sheridan, respectively, retirement, severance and other benefits, in more detail later in thisCompensation Discussion and Analysis.

Principal Components of Compensation Paid to Named Executive Officers in Fiscal 20112014

| Component | Principal Objectives | |||||||

| Fiscal 2014 Compensation | ||||||||

| Base Components | ||||||||

Salary | Compensate executives as appropriate for | Merit salary increases | ||||||

| Annual Bonus Awards | Motivate executives to focus on achievement of our annual business objectives. | Target incentives ranged from Actual | ||||||

| financial goals. | ||||||||

| Long-Term | ||||||||

Stock Options | Align executive interests with shareholder interests; create a strong financial incentive for achieving or exceeding long-term | The | ||||||

Performance Units | Align executive interests with shareholder interests; create a strong financial incentive for achieving long-term performance goals by encouraging total Company shareholder return that compares favorably to other utility-based companies or total AmeriGas Partners common unitholder return that compares favorably to other energy master limited partnerships. | The number of performance units awarded in Fiscal 2014 ranged from 7,950 to 63,000. Performance units (payable in UGI Corporation common stock, other than for Mr. Sheridan) will be earned based on total shareholder return of Company stock | For Mr. Sheridan, performance units | |||||

-26-

| • | Link Between Our Financial Performance and Executive Compensation |

The Committee sets rigorous goals for our executive officers that are directly tied to the top Fortune 500 companies forCompany’s financial performance and our total return to our shareholders, overand in the last 10 years.case of AmeriGas Partners, our total return to our unitholders. We believe that the principal performance-based components of our compensation program, namely our stock options and performance units, have effectively linked our executives’ compensation to our financial performance, as indicated below.

- 22 -

|  |

To better illustrate the total direct performance-based compensation paid or awarded to Mr. GreenbergWalsh in Fiscal 2011, 20102014, 2013 and 2009.2012, the following table is provided as supplemental information. A comparable illustration would apply to our other named executive officers. The information in the supplemental table below differs from the information in the Summary Compensation Table in several ways. Specifically, the table below (i) omits the columns captioned “Change in Pension Value and Nonqualified Deferred Compensation Earnings” and “All Other Compensation” because those dollarthese amounts are not generally relatedconsidered in establishing annual total cash compensation and total direct compensation and some of the amounts in those columns of the Summary Compensation Table can vary significantly from year to year. The table below shows Mr. Walsh’s direct compensation for the last three fiscal years. Mr. Walsh’s non-equity incentive compensation payouts reflect the Company’s improved EPS performance (ii) showsduring the three-year period, while his actual (or estimated in the case of performance related to Fiscal 2011)2014) performance unit payout values, and (iii) showspayouts during the intrinsic valueperiod clearly demonstrate shareholder returns for the Company that are in excess of stock options awarded based on UGI’s stock price on September 30, 2011.

| Total Intrinsic Value | ||||||||||||||||||||

| of Stock Options | ||||||||||||||||||||

| Granted in Fiscal | ||||||||||||||||||||

| Performance | 2011 (Valued at | Total Direct | ||||||||||||||||||

| Fiscal Year | Salary | Bonus | Unit Payout(1) | 9/30/11) | Compensation | |||||||||||||||

| 2011 | $ | 1,099,540 | $ | 1,072,821 | $ | 0 | (2) | $ | 0 | $ | 2,172,361 | |||||||||

| 2010 | $ | 1,067,500 | $ | 1,145,428 | $ | 4,578,638 | (3) | $ | 624,000 | $ | 7,415,566 | |||||||||

| 2009 | $ | 1,067,500 | $ | 1,591,643 | $ | 1,931,707 | (4) | $ | 555,000 | $ | 5,145,850 | |||||||||

Fiscal Year | Salary(1) | Non-Equity Incentive Compensation | Performance Unit Payout(2) | Intrinsic Value of Stock Options in Fiscal 2014 (Valued at 9/30/14) | Total Direct Compensation | |||||||||||||||

2014 | $ | 1,028,300 | $ | 1,974,336 | $ | 2,842,806 | (3) | $ | 2,612,250 | $ | 8,457,692 | |||||||||

2013 | $ | 861,710 | $ | 902,454 | $ | 1,250,970 | (4) | $ | 3,300,090 | $ | 6,315,224 | |||||||||

2012 | $ | 701,470 | $ | 413,478 | $ | 597,764 | (5) | $ | 2,716,875 | $ | 4,429,587 | |||||||||

| (1) | Mr. Walsh’s Fiscal 2013 salary reflects his service as President and Chief Operating Officer (until April 1, 2013) and his promotion to President and Chief Executive Officer (effective April 1, 2013). Mr. Walsh’s Fiscal 2012 salary reflects his service as the Company’s President and Chief Operating Officer. |

| (2) | Payout calculated for three-year performance periods based on calendar years, not fiscal years. |

Estimated based on performance through |

Actual payout for the |

Actual payout for the |

- 23 -

Short-Term Incentives — Annual Bonuses

Our annual bonuses are directly tied to one key financial metricmetrics for each executive — earnings per share– Adjusted EPS (in the case of Messrs. Greenberg, Walsh and Knauss)Oliver and Ms. Gaudiosi), net income of UGI Energy Services, LLC and its subsidiaries (“UGI Energy Services”), adjusted to exclude the loss on Midstream and Marketing’s commodity derivative instruments not associated with Fiscal 2014 transactions (in the case of Mr. Hall), and AmeriGas Propane’s earnings perbefore interest, taxes, depreciation and amortization, adjusted to exclude the mark-to-market loss in commodity derivative instruments at AmeriGas Partners common unit, as adjustedPropane (“Adjusted EBITDA”), and then modified for customer growth (in the case of Mr. Bissell),Sheridan). For Mr. Sheridan, a portion of his bonus is also tied to achievement of customer service goals. As illustrated in the below chart, when the Company’s Adjusted EPS exceeds the targeted goal, the annual bonus percentage paid to a named executive officer exceeds the targeted payout amount. Similarly, when Adjusted EPS is below the targeted goal, the annual bonus percentage paid to a named executive officer is less than the targeted payout amount. The forgoing correlation between the Adjusted EPS and Antargaz earnings before interest, taxes, depreciationbonus payout amounts would also be true with respect to the correlation between (i) Adjusted EBITDA and amortization (“EBITDA”) (in the case of Mr. Varagne).Sheridan’s bonus payout and (ii) UGI Energy Services’ adjusted net income and Mr. Hall’s bonus payout. Each Committee has discretion under our executive annual bonus plans to (i) adjust EPU,Adjusted EPS and Adjusted EBITDA results for extraordinary items or other events as the Committee deems appropriate, and (ii) increase or decrease the amount of an award determined to be payable under the bonus plan by up to 50 percent. For Fiscal 2011, each2014, the Committee exercised its discretion and adjusted the actual Adjusted EPS for bonus purposes to (i) exclude the impact of transition expenses incurred during Fiscal 2014 associated with a potential acquisition in determiningFrance, and (ii) include the executive bonuses set forthretroactive effects of changes in the table below.French tax legislation that had been excluded from Adjusted EPS. SeeCompensation Discussion and Analysis — Elements of Compensation — Annual Bonus Awards.

| Fiscal Year | UGI Corporation Targeted Adjusted EPS Range | UGI Corporation Adjusted EPS | % of Target Bonus Paid | |||||||||

2014 | $ | 1.73-$1.80 | $ | 1.98 | 160.0 | % | ||||||

2013 | $ | 1.63-$1.70 | $ | 1.59 | 95.9 | % | ||||||

2012 | $ | 1.56-$1.63 | $ | 1.17 | 62.0 | % | ||||||

-27-

Our long-term incentive compensation program, principally comprised of stock options and performance units, is intended to create a strong financial incentive for achievement of the Company’s long-term performance goals. In addition, linking equity to compensation aligns our executives’ interests with shareholder interests.

| % of Target | ||||||||||||||||||||||||

| UGI | Bonus Paid to | AmeriGas | ||||||||||||||||||||||

| Corporation | UGI | UGI named | Partners | AmeriGas | % of Target | |||||||||||||||||||

| Fiscal | Targeted | Corporation | executive | Targeted | Partners | Bonus Paid to | ||||||||||||||||||

| Year | EPS Range | Actual EPS | officers) | EPU Range | Actual EPU | Mr. Bissell | ||||||||||||||||||

| 2011 | $ | 2.30-$2.40 | $ | 2.06 | 88.7 | % | $ | 3.12-$3.26 | $ | 2.30 | 72.2 | % | ||||||||||||

| 2010 | $ | 2.20-$2.30 | $ | 2.36 | 107.3 | % | $ | 2.97-$3.14 | $ | 2.80 | 89.2 | % | ||||||||||||

| 2009 | $ | 2.10-$2.20 | $ | 2.36 | 149.1 | % | $ | 2.72-$2.86 | $ | 3.59 | 115.1 | % | ||||||||||||

Stock option values reported in the Summary Compensation Table reflect the valuation methodology mandated by SEC regulations, which is based on grant date fair value as determined under generally accepted accounting principles in the United States (“GAAP”). Therefore, the amounts shown under “Option Awards” in the Summary Compensation Table do not reflect performance of the underlying shares subsequent to the grant date. From the perspective of our executives,executives’ perspectives, the value of a stock option is based on the excess of the market price of the underlying shares over the exercise price (sometimes referred to as the “intrinsic value”) and, therefore, is directly affected by market performance of the Company’s stock. For example, all stock options granted to the named executive officers (other than Mr. Flexon, whose options were forfeited upon his resignation) in Fiscal 2011 have an exercise price of $31.58 per share, but by September 30, 2011, the market price per share of Company stock declined to $26.27. As a result of the marketCompany’s performance, of the Company’s stock, as of September 30, 2011, all options granted in Fiscal 2011 had no intrinsic value. As further demonstrated by the following table, which pertains to stock options granted in Fiscal 2011 to Mr. Greenberg, the fiscal year-end intrinsic value of the options granted to our executives during Fiscal 20112014 is lessmore than the amounts set forth in column (f) of the Summary Compensation Table.

| Number of Shares | Summary | Total Intrinsic | ||||||||||||||||||

| Underlying | Compensation | Exercise | Price Per | Value of | ||||||||||||||||

| Fiscal | Options Granted | Table Option | Price Per | Share at | Options at | |||||||||||||||

| Year | to Mr. Greenberg | Awards Value | Share | 9/30/11 | 9/30/11 | |||||||||||||||

| 2011 | 300,000 | $ | 1,629,000 | $ | 31.58 | $ | 26.27 | $ | 0 | |||||||||||

| 2010 | 300,000 | $ | 1,347,000 | $ | 24.19 | $ | 26.27 | $ | 624,000 | |||||||||||

| 2009 | 300,000 | $ | 1,218,000 | $ | 24.42 | $ | 26.27 | $ | 555,000 | |||||||||||

- 24 -

shareholder returns. The table below illustrates the intrinsic value of the stock options granted to Mr. Walsh in Fiscal 2014, Fiscal 2013 and Fiscal 2012, respectively.

Fiscal Year | Number of Share Underlying Options Granted to Mr. Walsh | Summary Compensation Table Option Awards Value | Exercise Price Per Share | Price Per Share at 9/30/14 | Total Intrinsic Value of Options at 9/30/14 | |||||||||||||||

2014 | 405,000 | $ | 1,992,060 | $ | 27.64 | $ | 34.09 | $ | 2,612,250 | |||||||||||

2013 | 307,500 | $ | 1,060,319 | $ | 21.81-$25.50 | (1) | $ | 34.09 | $ | 3,300,090 | ||||||||||

2012 | 187,500 | $ | 543,065 | $ | 19.60 | $ | 34.09 | $ | 2,716,875 | |||||||||||

| (1) | Mr. Walsh received 178,500 options on January 1, 2013 with an exercise price of $21.81 and, in connection with his promotion to Chief Executive Officer, received 129,000 options on April 1, 2013 with an exercise price of $25.50. |

Long-Term Incentives — Performance Units

Performance units are valued upon grant date in accordance with SEC regulations, based on grant date fair value as determined under GAAP. Nevertheless, the actual number of shares or partnership units ultimately awarded is entirely dependent on the total shareholder return (“TSR”) on UGI Corporation common stock (or, in the case of Mr. Bissell,Sheridan, total unitholder return (“TUR”) on AmeriGas Partners’ common units), relative to a competitive peer group, which will not be determined with respect to performance units granted in Fiscal 20112014 until the end of 2013.

2016.

-28-

| Total Average | UGI | |||||||||||||

| UGI | Shareholder | Corporation | ||||||||||||

| UGI Corporation | Corporation | Return of Peer | Performance | |||||||||||

| Total Shareholder Return | Total | Group | Unit Payout as a | |||||||||||

| Performance | Ranking Relative to Peer | Shareholder | (Excluding UGI | Percentage of | ||||||||||

| Period (Calendar Year) | Group | Return(1) | Corporation) | Target | ||||||||||

2009 — 2011(2) | 26th out of 34 (24th percentile) | 29.2 | % | 47.5 | % | 0 | ||||||||

| 2008 — 2010 | 2nd out of 32 (97th percentile) | 27.3 | % | -9.3 | % | 191.9 | ||||||||

| 2007 — 2009 | 13th out of 30 (58th percentile) | 0.2 | % | -9.5 | % | 121.6 | ||||||||

| 2006 — 2008 | 9th out of 29 (71st percentile) | 10.4 | % | -4.3 | % | 144.0 | ||||||||

Performance Period (Calendar Year) | UGI Corporation Total Shareholder Return Group | UGI Corporation Total Shareholder Return(1) | Total Average Shareholder Return of Peer Group (Excluding UGI Corporation) | UGI Corporation Performance Unit Payout as a Percentage of Target | ||||||||||

2012 — 2014(2) | 2nd out of 39 (97th percentile) | 109.4 | % | 53.9 | % | 193.4 | % | |||||||

2011 — 2013 | 20th out of 40 (50th percentile) | 46.8 | % | 50.1 | % | 100 | % | |||||||

2010 — 2012 | 19th out of 32 (42nd percentile) | 46.9 | % | 45.4 | % | 59.7 | % | |||||||

2009 — 2011 | 24th out of 34 (30th percentile) | 35.4 | % | 50.8 | % | 0 | % | |||||||

2008 — 2010 | 2nd out of 32 (97th percentile) | 27.3 | % | -9.3 | % | 191.9 | % | |||||||

| (1) | Calculated in accordance with | |

| (2) | Estimated |

| Total Average | ||||||||||||||

| Unitholder | AmeriGas | |||||||||||||

| Return of Peer | Partners | |||||||||||||

| AmeriGas Partners | AmeriGas | Group | Performance | |||||||||||

| Total Unitholder Return | Partners Total | (Excluding | Unit Payout as a | |||||||||||

| Performance | Ranking Relative to Peer | Unitholder | AmeriGas | Percentage of | ||||||||||

| Period (Calendar Year) | Group | Return(1) | Partners) | Target | ||||||||||

2009 — 2011(2) | 12th out of 19 (39th percentile) | 95.8 | % | 123.3 | % | 0 | ||||||||

| 2008 — 2010 | 6th out of 19 (74th percentile) | 63.7 | % | 56.5 | % | 147.8 | ||||||||

| 2007 — 2009 | 6th out of 19 (72nd percentile) | 49.6 | % | 32.9 | % | 145.4 | ||||||||

| 2006 — 2008 | 5th out of 20 (79th percentile) | 21.1 | % | 2.0 | % | 156.6 | ||||||||

As noted below, beginning with performance units granted in Fiscal 2011, total shareholder return for UGI will beCorporation is compared to companies in the Russell MidCap Utilities Index (exclusive of telecommunications companies) (“Adjusted Russell MidCap Utilities Index”), rather than to companies in the S&P Utilities Index. In addition, beginning in Fiscal 2010, total unitholder return for AmeriGas Partners is compared to the energy master limited partnerships and limited liability companies in the Alerian MLP Index, rather than to the group of selected publicly-traded limited partnerships engaged in the propane, pipeline and coal industries.

-29-

The link between the Company’s financial performance and our executive compensation program is evident in the supplemental tables provided above. The Committees believe there is an appropriate link between executive compensation and the Company’s performance.

| • | Compensation and Corporate Governance Practices |

The Committee is composed entirely of directors who are independent, as defined in the corporate governance listing standards of the New York Stock Exchange.

The Committee utilizes the services of Pay Governance LLC (“Pay Governance”), an independent outside compensation consultant.

The Company allocates a substantial portion of compensation to performance-based compensation. In Fiscal 2011, 80%2014, 84 percent of the principal compensation components, in the case of Mr. Greenberg,Walsh, and 62%66 percent to 74%75 percent of the principal compensation components, in the case of all other named executive officers, were variable and tied to financial performance or total shareholder return.

The Company awards a substantial portion of compensation in the form of long-term awards, namely stock options and performance units, so that executive officers’ interests are aligned with shareholders’ interests and long-term Company performance.

Annual bonus opportunities for the named executive officers are based primarily on key financial metrics. Similarly, long-term incentives are based on UGI Corporation common stock values and relative stock price performance (or, in the case of Mr. Bissell,Sheridan, performance relative to AmeriGas Partners common units).

We require termination of employment for payment under our change in control agreements (referred to as a “double trigger”). We also have not entered into change in control agreements providing for tax gross-up payments under Section 280G of the Internal Revenue Code since 2010. See COMPENSATION OF EXECUTIVE OFFICERS — Potential Payments Upon Termination or Change in Control.

We have meaningful stock ownership guidelines. See COMPENSATION OF EXECUTIVE OFFICERS — Stock Ownership Guidelines.

We have a recoupment policy for incentive-based compensation paid or awarded to current and former executive officers in the event of a restatement due to material non-compliance with financial reporting requirements.

We have a policy prohibiting the Company’s Directors and executive officers from (i) hedging the securities of UGI Corporation and AmeriGas Partners, (ii) holding UGI Corporation and AmeriGas Partners securities in margin accounts as collateral for a margin loan, and (iii) pledging the securities of UGI Corporation and AmeriGas Partners.